35+ charitable gift annuity calculator

Ad Our Income Annuity Calculator Can Help You Plan For The Future. Web Use this calculator to estimate the benefits you could enjoy with a CRS Charitable Gift Annuity plan.

Gift Calculator Peta

Web Charitable Gift Annuity Calculator You can make a gift to the American Cancer Society and receive guaranteed fixed payments for life.

. Ad A Donor-Advised Fund Allows You To Streamline Your Charitable Giving. Property Type Tax Bracket Second Beneficiary Age Rates for a Charitable Gift Annuity funded July 1 2022 or later. Web Planned Gift Calculator Use the calculator below to see how a planned gift can help you achieve your charitable and financial goals.

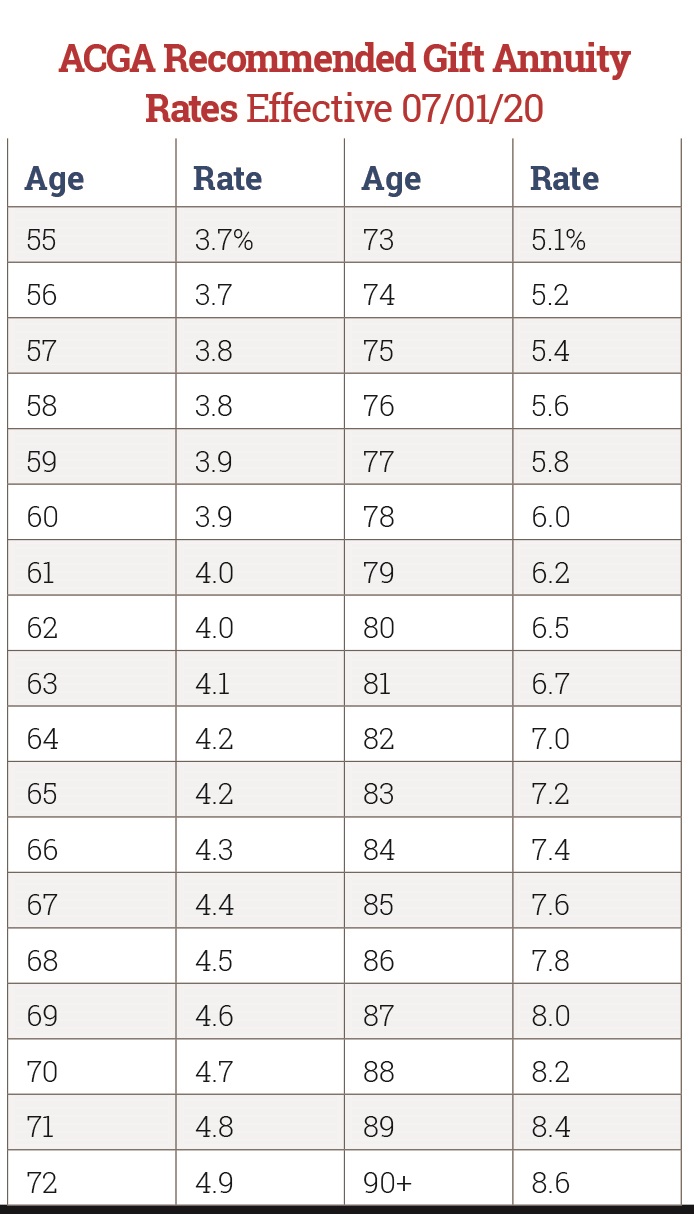

Get Started In Your Future. Web Legacy Toolkit Gift Calculator Gift Calculator Required fields marked with. The ACGAs current suggested maximum payout rates exceed the current maximum payout rates allowed by the State of New.

Research Fund Options That Fits Your Investment Strategy. Ad Making charitable contributions from IRA is easy. Benefit from fixed payouts beginning at a date of your choosing more than one year after the gift.

Get this must-read guide if you are considering investing in annuities. Web The amount of reserves needed to finance each gift annuity depends on the size of the annuity payments the ages of the annuitants and the mortality table and. Ad Conquer Cancer has Awarded 146M in Grants to Support Research for Every Cancer Type.

If cash funds the gift annuity enter the same value as Value of Property Current Return Enter the. Web Our gift calculators show you how a gift to the American Heart Association provides benefits to you and your loved ones while continuing to fight heart disease and. Learn some startling facts.

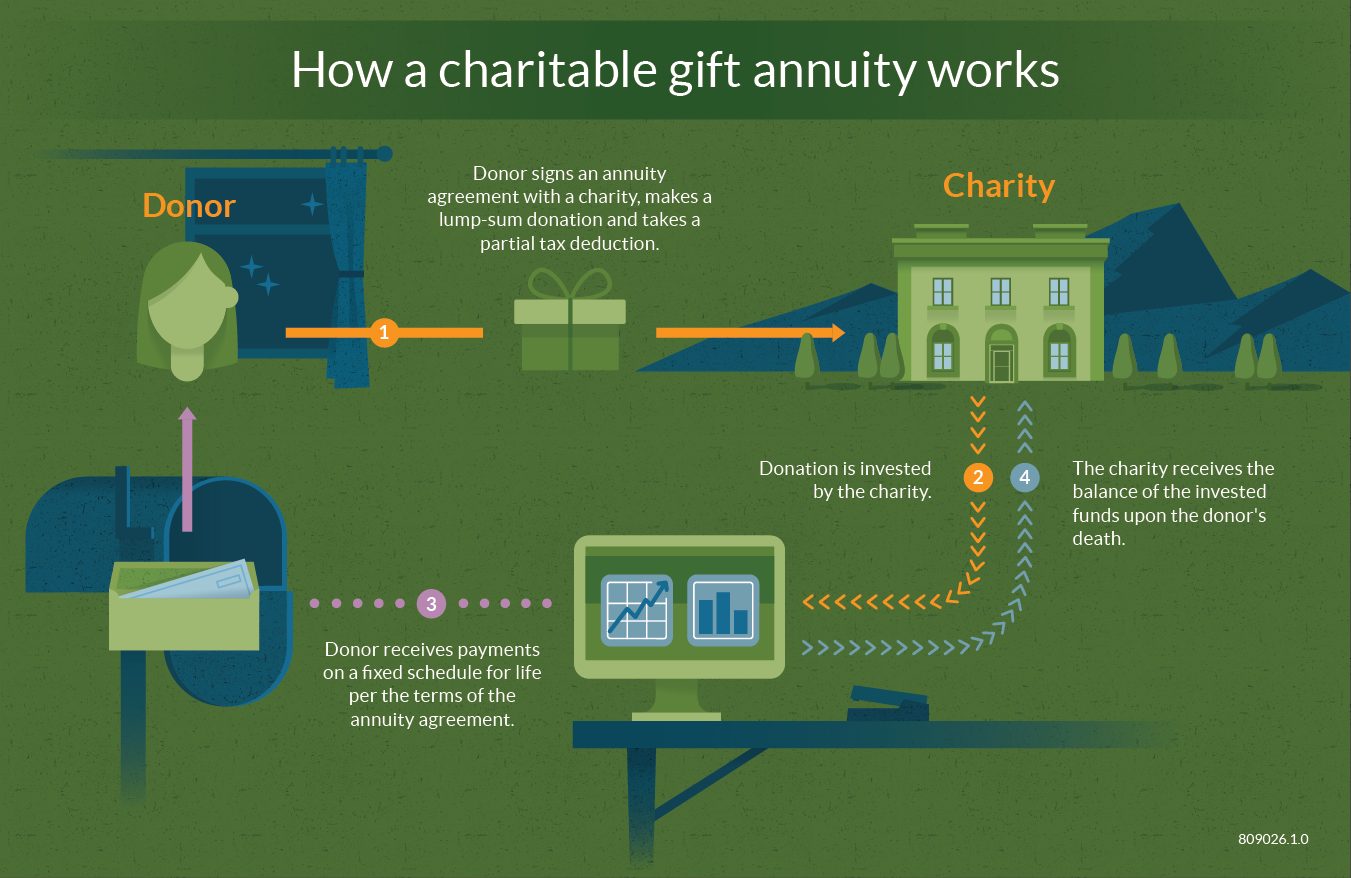

Donating appreciated securities will often reduce your tax bill and increase the dollars available for supporting your charity of choice. Want to receive fixed payments for life that will not fluctuate. You transfer your cash or appreciated property to our organization in exchange.

Calculate Part gift and part sale. The payment rate for joint gift. Web Establishing a charitable gift annuity with Mayo Clinic allows you to provide a gift to the area of your choosing while also receiving fixed payments for life.

Web Charitable Annuity Trust. Notice of rate increase Stanfords charitable. You can also qualify for.

Legal Name Address and Tax ID Catholic Relief Services - USCCB 228. Web Securities Donation Calculator. Just contact your IRA company to start.

IRA Donation--Contact your IRA company for details. Web A charitable gift annuity CGA might be right for you if you. Web Charitable Gift Annuity Calculator Healthy Living Conditions Support Professional Research Educator CPR ECC Shop Causes Advocate Giving Media Donate Now Wills.

Web Calculate Deferred gift annuity. Web Use this gift calculator to receive an estimate of how a charitable gift annuity charitable trust or retained life estate may provide benefits to you andor your loved ones. With the reduction of many federal.

Web Charitable Gift Annuity Calculator. Web The current rules for Qualified Charitable Distributions QCDs are broadened to permit you to allocate a one-time payment of up to 5000000 through a. No Phone Number Required.

We Offer Innovative Products For Retirement That Help You Keep Your Plans. In exchange the charity assumes a legal. Web The calculator below determines the charitable deduction for any of the following gift types.

Gift type Property type Amount of cash transferred Gift date Beneficiaries Gift term Age 1. Ad Conquer Cancer has Awarded 146M in Grants to Support Research for Every Cancer Type. Web A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity.

Web A charitable gift annuity is a great way you can make a great gift to our organization and benefit. Ad Compare Live Annuity Rates From Over 25 Top Companies. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Donate to Support Breakthroughs for All Types of Cancer Including the Rarest. Ad Annuities are often complex retirement investment products. Donate to Support Breakthroughs for All Types of Cancer Including the Rarest.

Payments may be much higher than your return on securities or CDs. Web The charitable tax deduction is a powerful tool for saving on your taxes but it may require some additional strategy to maximize your savings. For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year.

Bank Of America Charitable Gift Fund Allows You To Streamline Your Charitable Giving. The platform offers complete donation management tracking and integration. Have assets that would be advantageous to give.

Ad Givelify is the most widely-used charitable giving platform for nonprofits. 10 22 24 32 35 37.

Charitable Gift Annuity Rate Increases Texas A M Foundation

Donors Find Gift Annuities Can Stop Giving Wsj

How Early Retirement Impact Social Security Benefit

How Early Retirement Impact Social Security Benefit

What Is A Charitable Gift Annuity Fidelity Charitable

Journal Of Personal Finance Vol 14 Issue1 By Iarfc Issuu

Gift Calculator Pomona Plan

Giftlegacy Presents Calculator Main Page American Bible Society

Charitable Gift Annuities For Ministries Christian Financial Advisors

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuity Licensing Compliance In California Harbor Compliance Www Harborcompliance Com

Acga Announces New Suggested Charitable Gift Annuity Rates Sharpe Group

Stelter Insights Special Update New York Charitable Gift Annuity Rates

Charitable Gift Annuities 1 Introduction Youtube

A Gift That Pays You Back Giving To Johns Hopkins

Gift Annuity Calculator

The Ultimate Practice Building Library Ultimate Estate Planner